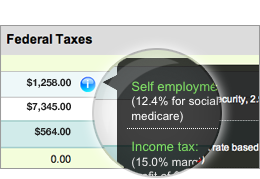

Many freelancers–including me–truly dread tax time. And many of us find ourselves needing to file an extension so we can eventually get our act together and get the paperwork submitted.

Many freelancers–including me–truly dread tax time. And many of us find ourselves needing to file an extension so we can eventually get our act together and get the paperwork submitted.

Since I am the head of the Chicago Chapter of the Freelance Tax Procrastinator’s Union Local 312, I thought it would be a very good idea to post something about how to file an extension on your Big Scary Federal Income Tax paperwork for 2012.

AND since I am NOT a tax professional, it seems best to simply quote the IRS chapter-and-verse on the subject rather than try to give you some kind of pithy words of wisdom.

Thus sayeth the Internal Revenue Service:

“If you are not able to file your federal individual income tax return by the due date, you may be able to get an automatic 6-month extension of time to file. To do so, you must file Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return by the due date for filing your calendar year return (usually April 15) or fiscal year return. This form is also available en español.”

See the IRS official site for more information, but it’s critical to note the caveat that you must apply BEFORE the due date (traditionally April 15 unless it falls on a weekend, in which case there may be a shift to the previous or following business day). Don’t delay if you need an extension–follow the links and fill out the paperwork as soon as you can.

Joe Wallace is a freelance writer, social medial manager, editor, roving DJ and vinyl collector. His vinyl blog is Turntabling.net and features a large gallery of truly awful record album covers. He has not yet filed his income tax extension paperwork, which means the clock is ticking….

An interesting article at

An interesting article at  Mark your calendars, April 15, 2009 is fast approaching. Tax time is hell time for most freelancers, but here’s a little hint that will make tax season 2010 seem like a breeze. Grab your pens, kids, this one’s a real brain tickler.

Mark your calendars, April 15, 2009 is fast approaching. Tax time is hell time for most freelancers, but here’s a little hint that will make tax season 2010 seem like a breeze. Grab your pens, kids, this one’s a real brain tickler.